Industry

strategic implications of user expectations and choice

All industries are driven by customer needs, wants,

and expectations. Customers rarely get the "perfect" product, and

in fact rarely expect it, even though this fact is equally rarely

noticed.

Dissatisfaction is a powerful driver of choice by

customers. Customers rarely become dissatisfied with their purchase

unless they see

a better

one was

possible.

Product

variation

is

necessary for customers to experience dissatisfaction.

Thus, all purchasing choice

is driven by product variation: without variation

there's no scope for dissatisfaction or choice. But once product

variation and differentiation

appear, choice follows.

The present widely recognised problem of hard-to-open

bags resonates with virtually every user. This applies to the

market for simple side-gusseted and side-welded (un-gusseted) bags.

The 'hard-to-open' problem now constitutes an industry

instability. Why? ... because a near-zero-cost solution has

finally been found, but only Licensees can use.

This

solution 'raises the bar' of performance and will affect customer

expectations.

Users have hitherto been tolerant and forgiving because

the problem has been perceived as 'the nature of the beast', i.e.

unavoidable. Once users witness the solution, however,

expectations of performance will rise, and users will increase

complaints and product returns, and will migrate toward Licensees.

BETTER USEABILITY --> PRODUCT PREFERENCE --> PURCHASE

PREFERENCE

Market

dynamics and Industry consolidation

Your

choice as a manufacturer is simple: do you want this

before your competitor gets it?

What's market worth?

What's control worth? |

The flip side of 'industry instability' is business

opportunity. The new Licensable IP can be a powerful business

tool for Licensees. This solution will differentiate a class of

products,

competing in all the traditional applications of side-gusseted

or side-welded bags.

After

all those years of "bags that fight back", customers will witness

the improvement with relief. Their performance

expectations

will be raised, they will demand and seek the product that

relieves them of the traditional headache. That will cause a rapid

shift

of market toward our Licensees; in some market segments our

target for this shift is 80%.

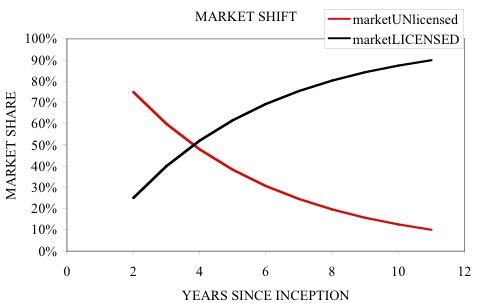

How could that play out? Suppose for example that

in the first two years SFT Licenses under 25% of the current production/supply

companies, or the equivalent in present market. Suppose only 20%

of the remaining market's customers move to Licensees each year:

within 10 years virtually the entire market will be concentrated

in Licensees.

If the market switch is completely absorbed by the

initial set of Licensees, that 10 years would see their own market

multiplied by a factor of 3.6. The model is simple; if however

we acknowledge that the customer migration rate would increase,

then the market consolidation could occur more quickly.

The main driver of the industry shift is the benefits

perceived by the user. Similar preference at the retail level will

influence consumer choice of branded products. SFT's branding strategy

is to allow Licensee brands to dominate on product or packaging

while benefiting from the presence of SFT's brand as a symbol of

quality.

After a small number of years it is likely that much

of the market will have migrated away from non-Licensees. With

markets favouring Licensees, non-Licensees would either move to

other segments of the business or close. The industry will stabilise

around the groups of companies able to meet the higher expectations

of customers.

Licenses will allow Licensees to make, commission,

use, and sell. Though not shown in the table, the retail consumer

or the employee actually using bags is the driver for the market

shift. Consumers drive retailers to stock the Licensed product.

Employees using bags drive employers to supply bags that don't

waste their time

|

MANUFACTURER

|

SUPPLIER/

DISTRIBUTOR

|

MAJOR

USER

|

END

USER (CONSUMER or EMPLOYEE)

|

license allows

|

make & sell

|

commission & sell

|

commission and use

|

n/a

|

practical advantage

|

fewer product returns;

more customers

|

fewer product returns;

more customers

|

saved time/wages

reduced bag waste

improved workflow

better hygiene

|

less frustration

easier work

fewer wasted bags

saved time

no spitting needed

|

strategic advantage

|

defend market, gain market

(in response to customer demand)

|

defend market, gain market

(in response to customer demand)

|

increased competitiveness

|

improved satisfaction with

work/task

|

How

to beat offshore

cut-rate producers? ... control the market

Offshore

cut-rate producers have taken a large market share and even with

countervailing duties (sometimes dodged by shifiting the site

of manufacture to some other country not mentioned in the regulation)

can be difficult to compete against. As one producer told us

"I can't even buy the resin for what they charge for finished

bags".

So,

here is an opportunity: tilt the playing field in your favour.

With

a License from SFT, market SFT's better bags; order the bags

(to the SFT-enabled specification) from your offshore competition,

who can't sell the same specification to your market without

a

License.

SFT's

strategy

Clearly, the consumer will demand

the improved bags. To facilitate that, our Licensing strategy is

aimed at having the improved product priced at no perceptible cost

increase.

Our

strategy is to License only a portion of the current market capacity,

and

let that absorb market from non-Licensees.

What's

it worth to not let your competitors get this first?

Contact us to discuss

how you can be on board early to gain the greatest

advantages.